AKA’s Delta Epsilon Omega Chapter Equips Young Women with Real-World Money Skills

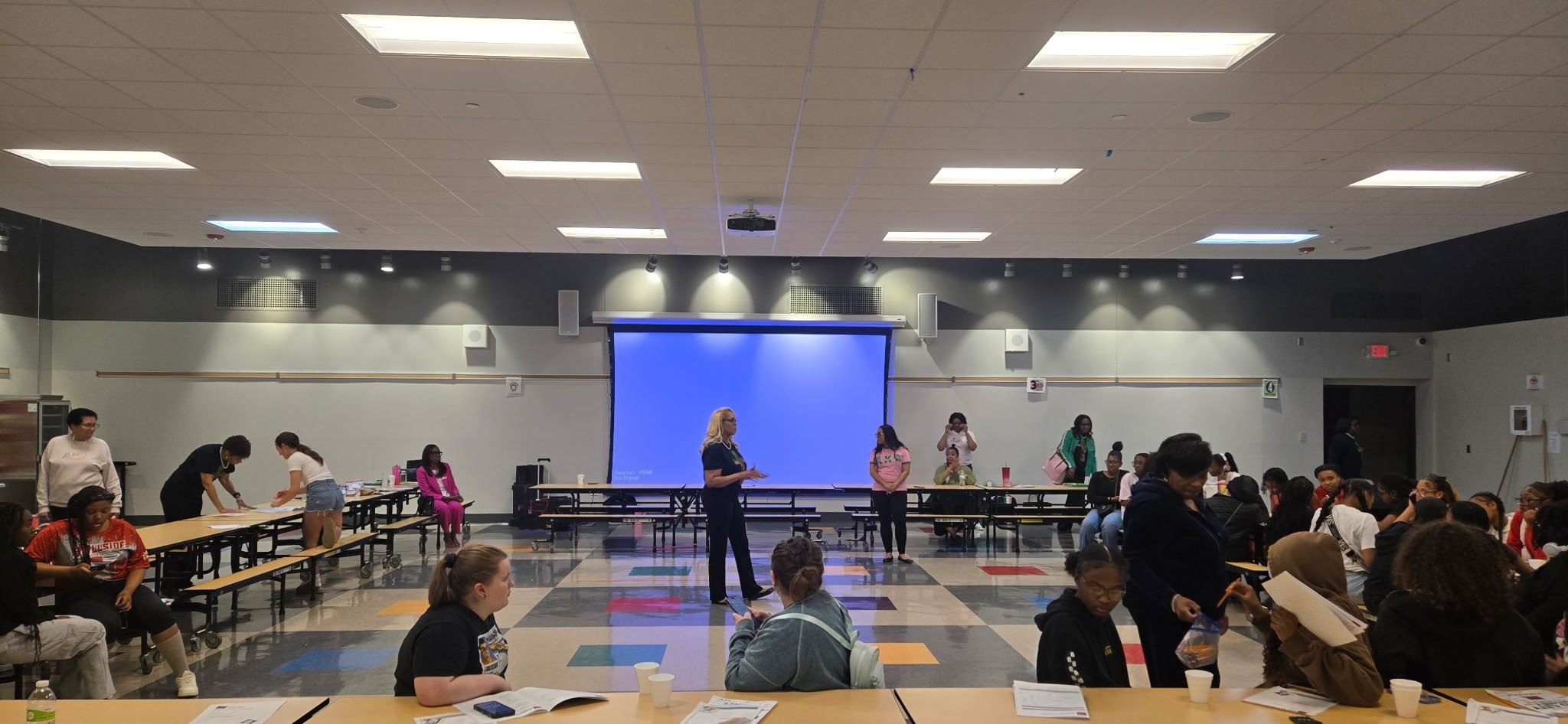

Photo courtesy of Delta Epsilon Omega Chapter of Alpha Kappa Alpha Sorority, Incorporated

On April 12, the Delta Epsilon Omega Chapter of Alpha Kappa Alpha Sorority, Incorporated, partnered with Urban Financial Services Coalition and Girls Inc. of Omaha to bring financial literacy to life for 34 young women. The group hosted a hands-on financial simulation that turned lessons about money into a powerful, real-world experience.

Held at Girls Inc. in North Omaha, the session was led by Chapter committee co-chairs Sheila Estes and Christie McDonald. Using the interactive "Mad Money" simulation, participants explored how to manage money, make smart financial choices, and understand the impact of their decisions - all in a safe, risk-free environment. The event was part of Alpha Kappa Alpha’s national “Building Our Economic Wealth” program initiative.

“This year, we’re putting education into action,” said Chapter President Anita Johnson. “Our goal with this simulation wasn’t just to teach budgeting - it was to give these young women the confidence and clarity they need to make smart financial decisions in their everyday lives. When we equip them with these tools, we’re not only preparing them for personal success - we’re also nurturing the next generation of community and economic leaders.”

From understanding expenses to planning for the future, the young women walked away with more than knowledge—they left empowered and inspired.

Key Takeaways

Understanding Budgets and Surprise Expenses

Nearly everyone (92%) knew that a budget is a plan for saving and spending money, not just a wish list or a list of fun things to buy. Students also understood that unexpected costs, like a surprise car repair, can derail finances. In fact, 80% said having a budget was the best example of how to manage unexpected expenses.

Saving and Investing – It’s for Everyone

Most students agreed that having a savings account is a smart move — 100% said it’s important for financial stability. And a big majority (92%) knew that investing isn’t just for rich people — it’s something we all can do with good planning.

Smart Moves With Extra Money

When asked what to do with a bonus at work, 80% said: save some, invest a little, and maybe spend a small amount on self. And when it comes to buying something big, like a new laptop, almost 96% said the best plan is to save little by little each month, instead of using credit or borrowing from others to make the purchase.

What they loved

Learning how to budget like an adult

Talking to others and getting advice

Getting positive feedback for their decisions

The feeling of being in control of their money

Simply getting to shop!

Biggest Surprises

Spending money or seeing how expensive life can be

Dealing with childcare costs or debt

One young lady said it was tough because “at the beginning I didn’t know what to do,” but even that shows just how real the experience felt. The girls said they left understanding that the simulation wasn’t just about math — it was about real life. Students learned how to spend wisely, plan ahead, and stay out of debt. Even if some parts were frustrating, most students walked away smarter, stronger, and more prepared to take on money in the real world.